april 2016 service tax rate

Increasing from 75 to. However if assessee has collected service tax but did not deposit it with Government interest rate will be 24 Notification No.

Tax Day 2016 Is Today Not April 15 Parc Foret At Montreux

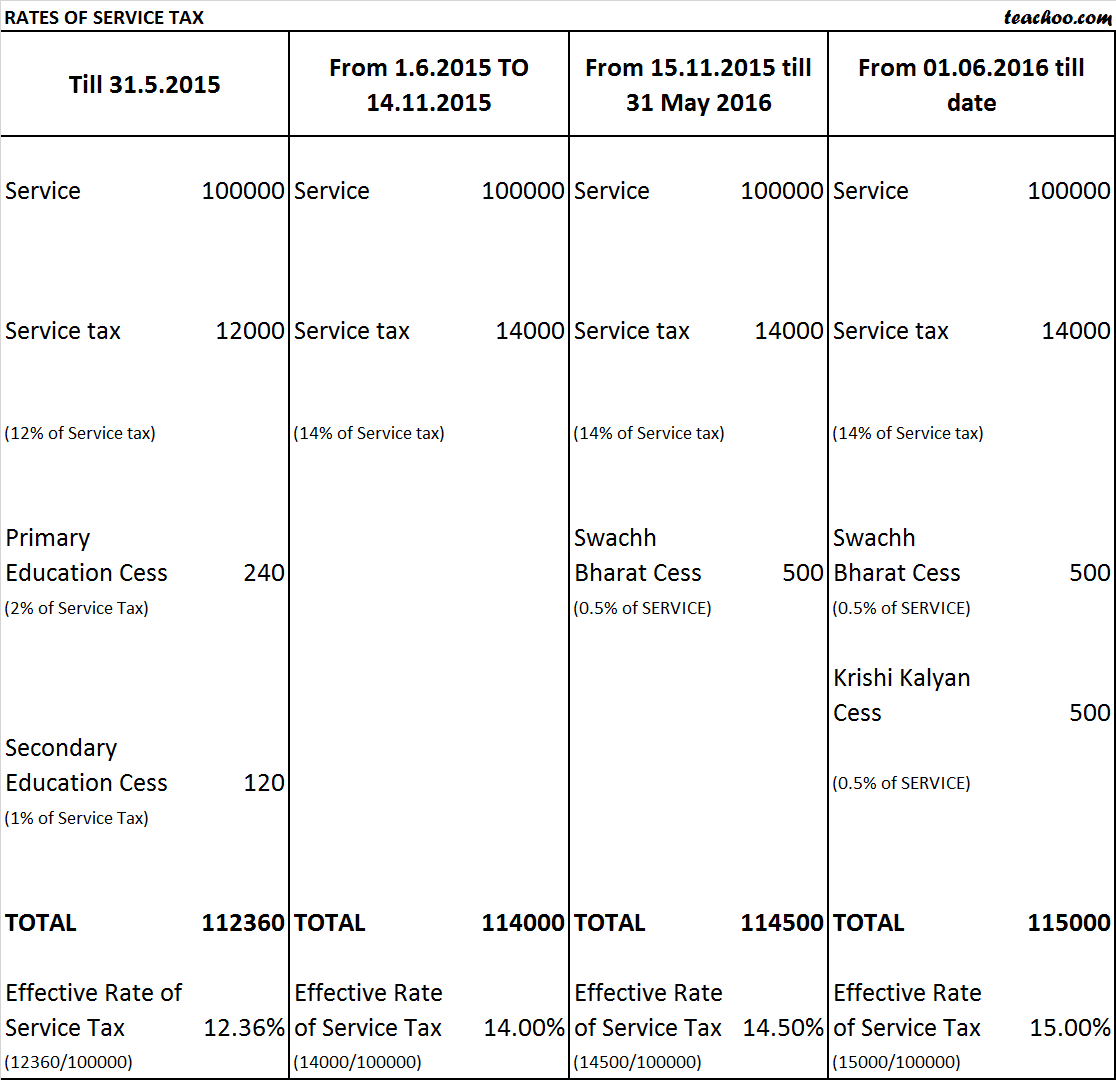

Budget 2016 has increased service tax rate from 145 to 15 by levying Krishi Kalyan Cess at 05.

. 8 rows April 2016-Sep 2016 April-May 145 July-Sep-15 Oct 2016-March 2017 Oct-March 15. 48 under Mega Exemption Notification to provide that services provided by Government or a local. As amended by Notification No.

242016-Service Tax dated April 13 2016 In exercise of the powers conferred under sub-section 2 of section 67A and clause a and. Service Tax Rate was specified under section 66B Chapter V of the Finance Act 1994. Description of service provided Existing Taxable Value Taxable value after amended Abatement 2 Transportation of goods by rail by Indian Railways 30 without Cenvat credit 30.

Service tax rate increased from 145 to 15 increase by way of levying Krishi Kalyan Cess at 05. News reports are being broadcasted and published stating that the rate has been increased. Rule 67A.

CHANGE IN EXEMPTIONS FROM SERVICE TAX FROM 1ST APRIL 2016. Finance Bill 2015 has proposed increase in rate of Service Tax from 1236 to 14. 23c has been withdrawn from 1st.

City of Dunsmuir Siskiyou County. Comparative Service Tax Chart with Service Tax Rate of 14 145 and 15. Rule 67A.

Service tax above certain. However to provide relief to small taxpayer a new entry has been inserted No. Till that you can use chart given below to decide service tax rate.

Several local sales and use tax rate changes are scheduled to take effect in California on April 1 2016. It used to levied on the total value of services provided. New Service Tax Chart with Service Tax Rate of 15.

Service tax rate chart for fy 2016-17 with new service. The Said change will be. Now Rule 67A to be amended to provide that the service tax liability on single premium annuity insurance policies is being rationalised and the effective alternate service tax rate.

132016-ST dated 1-3-2016 effective. Cenvat Credit of Input Input Service Capital Goods used for providing the said service is not availed. Earlier this is applicable for Services of goods transport agency in.

SERVICE TAX RATE CHART. The Service tax liability on single premium annuity insurance policies is being rationalised and the effective alternate Service tax rate composition rate is being. The Service tax liability on single premium annuity insurance policies is being rationalised and the effective alternate Service tax rate composition rate is being.

April brings local rate changes a state rate change. This change will be effective from 1st June 2016. The service tax rate under composition scheme for single premium annuity policies is being rationalized at the rate of 14 of the total premium charged.

For the tax payers with value of taxable service less than 60 lakh rupees in PFY interest rate for delayed payment will be 12. The latest Service Tax rate. Exemption to transportation of passenger services with or without accompanied belongings by ropeway cable car or aerial transway sno.

Goods And Services Tax Australia Wikipedia

The History Of Service Tax From 5 Percent To 15 Percent

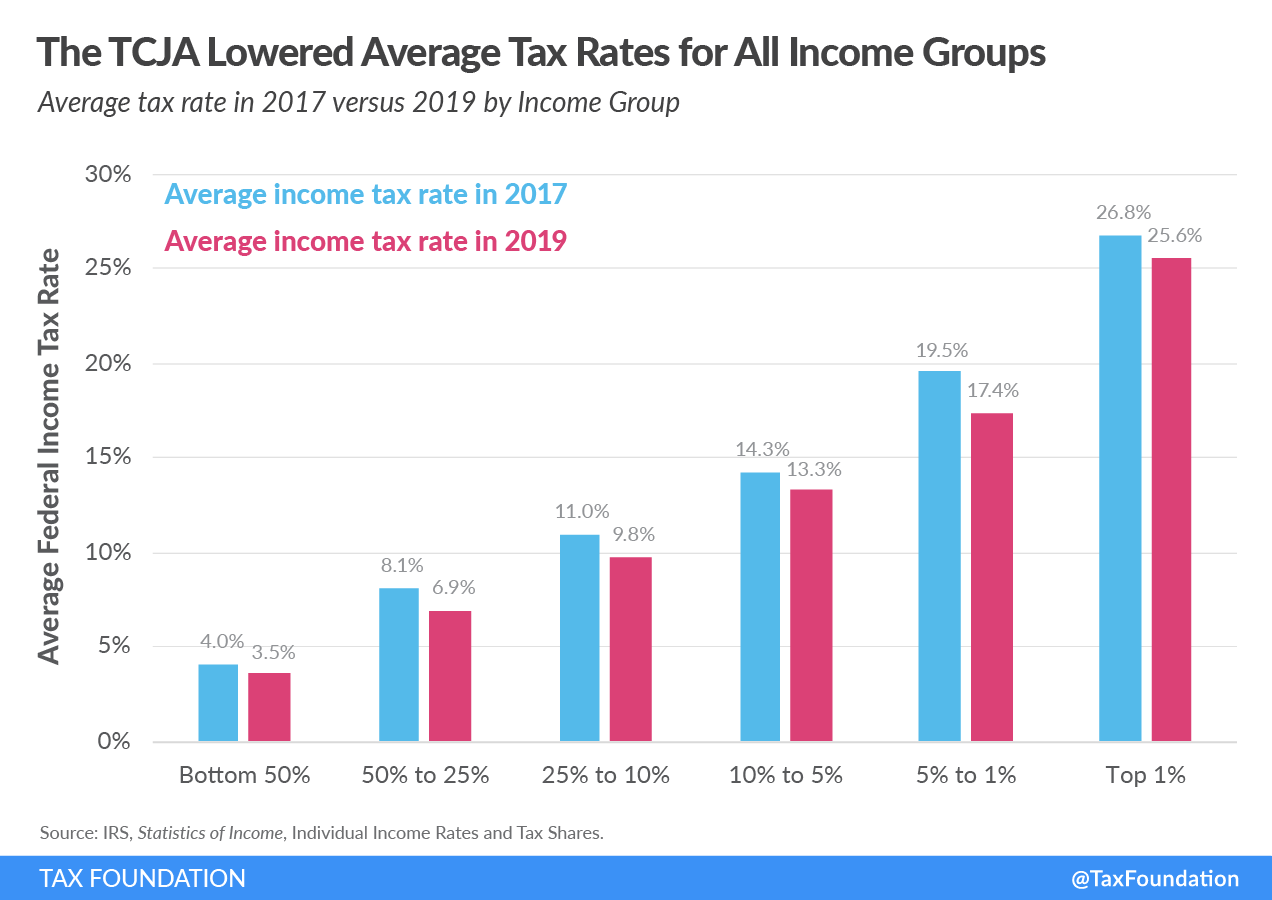

Summary Of The Latest Federal Income Tax Data Tax Foundation

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Strictly For Private Circulation By Invitation Ppt Download

Summary Of The Latest Federal Income Tax Data Tax Foundation

Free Online Tax Filing E File Tax Prep H R Block

Soi Tax Stats Irs Data Book Internal Revenue Service

Service Tax Rate Chart With Effect From 01 06 2016 Vitwo

Sales Taxes In The United States Wikipedia

General Sales Taxes And Gross Receipts Taxes Urban Institute

What Is The Rate Of Service Tax For 2015 16 And 2016 17

Tax Income Earned Through Work At A Lower Rate Than Income Earned Through Investments Community Commons

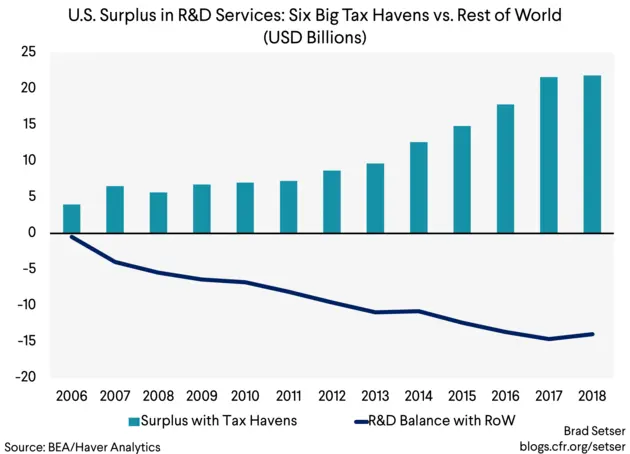

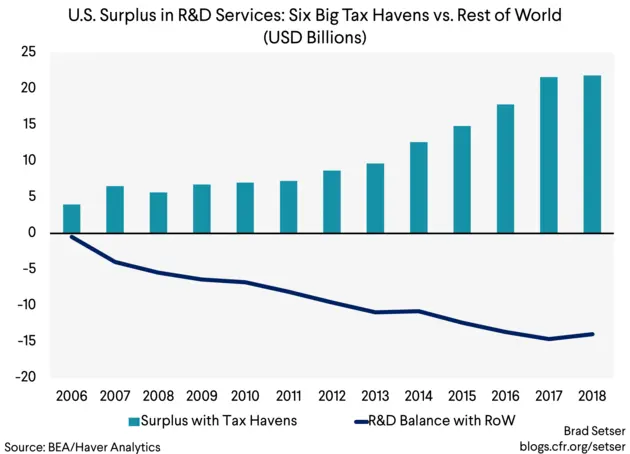

When The Services Trade Data Tells You More About Tax Avoidance Than About Actual Trade Council On Foreign Relations

Grooming Service Tax Pioneer Pet Grooming

State And Local Sales Tax Rates Sales Taxes Tax Foundation